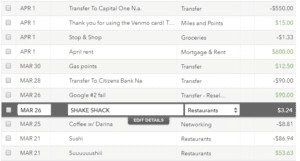

Readers of a bank statement must figure out where one field ends and another begins. But these other fields often end up adding to the general confusion. Beyond these three fields, some banks will choose to include a small set of other fields that may aid a consumer in tracking down the specific purpose of a payment. The appearance of those bits of info is mandated by a combination of Regulation E, which lays out federal guidelines for electronic payments, and NACHA Operating Guidelines, which dictate the need for these fields to be included by all participants of the ACH. Receiving Individual Name (22 characters).Company Entry Description (10 characters).There are a few fields that always appear (in various forms) on a consumer's bank statement. What might appear as AMERICAN EXPRESS ACH PMT 190417 A1110 SAMUEL I AARONS at one bank would show up as AMERICAN EXPRESS DES:ACH PMT INDN: SAMUEL I AARONS CO ID: XXX123 PPD at a different bank. To be concise, banks often take individual fields from an ACH payment and join them together on a single line to form the entries. A lot has been written about ACH and more directly NACHA, the standards body that guides how ACH payments are formatted when being sent between banks.Īlthough a standard for ACH formats exists and is widely supported, there is no equivalent agreement for how the payment might appear on a recipient's bank statement. For a typical consumer bank account, a majority of the electronic transfers are handled via the Automated Clearing House (ACH). To answer these questions we must first understand the payment systems themselves. We see familiar company names like Venmo and American Express and remember that we loaned our friends money or paid off our credit cards.īut what about the rest of the entry? The random numbers and letters that follow? Where does that information come from? And more importantly who controls what shows up? Understanding the payment systems We almost never give these entries a second thought. Sometimes they’re as simple as: VENMO PAYMENT 1835782906 SAM AARONS and other times they’re more confusing: FUNDRISE G 2025840550 A19100 2J5JFW58EZM41A8 SAM AARONS. Semi-cryptic entries on our bank statements. If you’re having trouble accessing the specific range you want, try adjusting the end date before you adjust the start date .What is this charge on my bank statement?.For example: If you need to access your transaction history for all of 2020, you’ll need to access four separate date ranges: Jan 1 – Mar 31 Apr 1 – Jun 30 Jul 1 – Sep 30 Oct 1 – Dec 31.If you need to access a period of time longer than 90 days, you’ll need to search multiple date ranges and view/download them separately.

PRINT VENMO TRANSACTION HISTORY DOWNLOAD

Note: You can view any period of your entire transaction history from the beginning of your account, but you can only view or download up to 90 days at a time. You can then download your transaction history as a CSV file (a spreadsheet) by clicking the “Download CSV” button next to the date selection. To view your complete transaction history or statement, log into your Venmo profile from a web browser (not the Venmo app).

PRINT VENMO TRANSACTION HISTORY HOW TO

How to get your transaction history or statement from Venmo.

You also have a right to obtain a 60-day history of your Spending Account transactions and can contact us in several ways: Carefully review your statements each statement period and notify Chime of any errors within 60 days of your statement becoming available. Spending Account statements are considered to be correct. What if I see an error in my monthly statement? If you need statements for a specified time period, let Chime know and they will gladly provide them to you! How do I download account statements from Chime?Īll members are provided with paperless monthly statements in their online accounts at You can download or print your monthly statements by going to your online account and clicking the statement tab on the left-hand side. Statements for the previous calendar month are made available to you on the 5th of each month.Īre there any limitations in getting statements for a certain period? Tap the blue info icon on the lower-right hand corner.Locate and select your Apple Pay Cash card.How do I request an Apple Pay Cash statement?

0 kommentar(er)

0 kommentar(er)